Marriott Vacations Worldwide Reports Second Quarter 2024 Financial Results

ORLANDO, Fla. – July 31, 2024 – Marriott Vacations Worldwide Corporation (NYSE: VAC) (“MVW,” the “Company,” “we” or “our”) reported second quarter 2024 financial results.

Second Quarter 2024 Highlights

- Consolidated Vacation Ownership contract sales declined 1% compared to the second quarter of 2023 to $449 million. Excluding Maui, contract sales increased 3% compared to the prior year.

- The Company recorded a $70 million increase to its sales reserve reflecting higher expected future defaults on its existing vacation ownership notes receivable portfolio.

- Net income attributable to common stockholders was $37 million compared to $90 million in the prior year, and fully diluted earnings per share was $0.98. Net income attributable to common stockholders reflects a $45 million impact of the higher sales reserve.

- Adjusted net income attributable to common stockholders was $42 million compared to $90 million in the prior year, and adjusted fully diluted earnings per share was $1.10.

- Adjusted EBITDA decreased 29% compared to the prior year to $157 million reflecting a $57 million net increase to the Company’s sales reserve.

- The Company updates its full-year outlook.

“We had a mixed second quarter, with rentals exceeding our expectations and lower VPGs negatively impacting our contract sales. In addition, we have not seen the necessary improvements in our loan delinquencies, so we increased our sales reserves to reflect higher expected defaults,” said John Geller, president and chief executive officer. “Demand for travel remains strong with our resorts running 90% occupancy in the second quarter, tours increasing 5% and owner VPG’s flat compared to last year. However, first time buyer VPGs declined versus last year and Maui is recovering slower than our original expectations. As a result, we adjusted our contract sales guidance for the second half of the year.”

In the tables below “*” denotes non-GAAP financial measures. Please see “Non-GAAP Financial Measures” for additional information about our reasons for providing these alternative financial measures and limitations on their use.

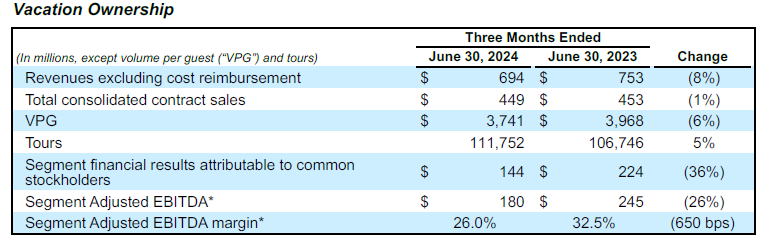

Contract sales declined 1% primarily due to the impact of the Maui wildfires. Excluding Maui,

contract sales increased 3%. Segment Adjusted EBITDA declined compared to the prior year driven

by lower Development and Financing profit, including an increase to the Company’s sales reserve,

partially offset by higher Management and exchange and Rental profit.

Sales Reserve

The Company recorded a $70 million increase in its sales reserve in the second quarter resulting in

a $45 million impact to Net income attributable to common stockholders and a $57 million net

impact to Adjusted EBITDA.

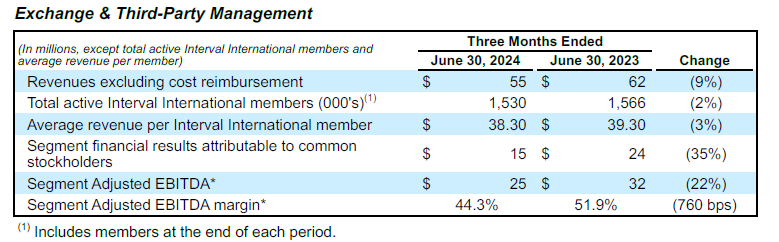

Revenues excluding cost reimbursements decreased year-over-year, driven primarily by lower

exchange volumes at Interval International and reduced management fees at Aqua-Aston. Segment

Adjusted EBITDA declined year-over-year due to lower revenue.

Corporate and Other

General and administrative costs decreased $10 million in the second quarter of 2024 compared to

the prior year driven by lower IT and compensation-related costs.

Balance Sheet and Liquidity

During the second quarter the Company repurchased approximately 131,000 shares of its common

stock for $12 million and paid $27 million in dividends.

The Company ended the quarter with $820 million in liquidity, including $206 million of cash and

cash equivalents and $543 million of available capacity under its revolving corporate credit facility.

The Company had $3.1 billion of corporate debt and $2.1 billion of non-recourse debt related to its

securitized vacation ownership notes receivable at the end of the second quarter.

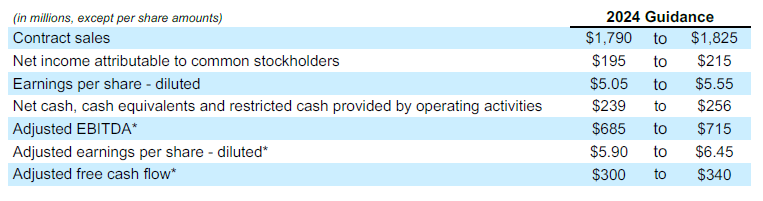

Full Year 2024 Outlook

The Company provides updated full year 2024 guidance as reflected in the chart below. The

Financial schedules that follow reconcile the following full year 2024 expected GAAP results for the

Company to the non-GAAP financial measures set forth below.

Non-GAAP Financial Information

Non-GAAP financial measures are reconciled and adjustments are shown and described in further

detail in the Financial Schedules that follow. Please see “Non-GAAP Financial Measures” for

additional information about our reasons for providing these alternative financial measures and

limitations on their use. In addition to the foregoing non-GAAP financial measures, we present

certain key metrics as performance measures which are further described in our most recent Annual

Report on Form 10-K, and which may be updated in our periodic filings with the U.S. Securities and

Exchange Commission.

Second Quarter 2024 Financial Results Conference Call

The Company will hold a conference call on August 1, 2024 at 8:30 a.m. ET to discuss these

financial results and provide an update on business conditions. Participants may access the call by

dialing (877) 407-8289 or (201) 689-8341 for international callers. A live webcast of the call will also

be available in the Investor Relations section of the Company’s website at ir.mvwc.com. An audio

replay of the conference call will be available for 30 days on the Company’s website.

About Marriott Vacations Worldwide Corporation

Marriott Vacations Worldwide Corporation is a leading global vacation company that offers vacation

ownership, exchange, rental and resort and property management, along with related businesses,

products, and services. The Company has approximately 120 vacation ownership resorts and

approximately 700,000 owner families in a diverse portfolio that includes some of the most iconic

vacation ownership brands. The Company also operates an exchange network and membership

programs comprised of more than 3,200 affiliated resorts in over 90 countries and territories, and

provides management services to other resorts and lodging properties. As a leader and innovator in

the vacation industry, the Company upholds the highest standards of excellence in serving its

customers, investors and associates while maintaining exclusive, long-term relationships with

Marriott International, Inc. and an affiliate of Hyatt Hotels Corporation for the development, sales

and marketing of vacation ownership products and services. For more information, please visit

www.marriottvacationsworldwide.com.

The Company routinely posts important information, including news releases, announcements and

other statements about its business and results of operations, that may be deemed material to

investors on the Investor Relations section of the Company’s website,

www.marriottvacationsworldwide.com. The Company uses its website as a means of disclosing

material, nonpublic information and for complying with the Company’s disclosure obligations under

Regulation FD. Investors should monitor the Investor Relations section of the Company’s website in

addition to following the Company’s press releases, filings with the SEC, public conference calls

and webcasts.

Note on forward-looking statements

This press release and accompanying schedules contain “forward-looking statements” within the

meaning of federal securities laws, including statements about expectations for full year 2024

outlook for contract sales, results of operations, cash flows and future defaults on vacation

ownership notes receivable. Forward-looking statements include all statements that are not

historical facts and can be identified by the use of forward-looking terminology such as the words

“believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,”

“might,” “should,” “could” or the negative of these terms or similar expressions. The Company

cautions you that these statements are not guarantees of future performance and are subject to

numerous and evolving risks and uncertainties that we may not be able to predict or assess, such

as: a future health crisis and responses to such a health crisis, including possible quarantines or

other government imposed travel or health-related restrictions and the effects of a health crisis,

including the short and longer-term impact on consumer confidence and demand for travel and the

pace of recovery following a health crisis; variations in demand for vacation ownership and

exchange products and services; worker absenteeism; price inflation; difficulties associated with

implementing new or maintaining existing technology; changes in privacy laws; the impact of a

future banking crisis; impacts from natural or man-made disasters and wildfires, including the Maui

wildfires; global supply chain disruptions; volatility in the international and national economy and

credit markets, including as a result of the ongoing conflicts between Russia and Ukraine, Israel and

Gaza, and elsewhere in the world and related sanctions and other measures; our ability to attract

and retain our global workforce; competitive conditions; the availability of capital to finance growth;

the impact of changes in interest rates; the effects of steps we have taken and may continue to take

to reduce operating costs; political or social strife; and other matters referred to under the heading

“Risk Factors” in our most recent Annual Report on Form 10-K, and which may be updated in our

future periodic filings with the U.S. Securities and Exchange Commission. All forward-looking

statements in this press release are made as of the date of this press release and the Company

undertakes no obligation to publicly update or revise any forward-looking statement, whether as a

result of new information, future events, or otherwise, except as required by law. There may be

other risks and uncertainties that we cannot predict at this time or that we currently do not expect

will have a material adverse effect on our financial position, results of operations or cash flows. Any

such risks could cause our results to differ materially from those we express in forward-looking

statements.

For full financial schedules, please click here.